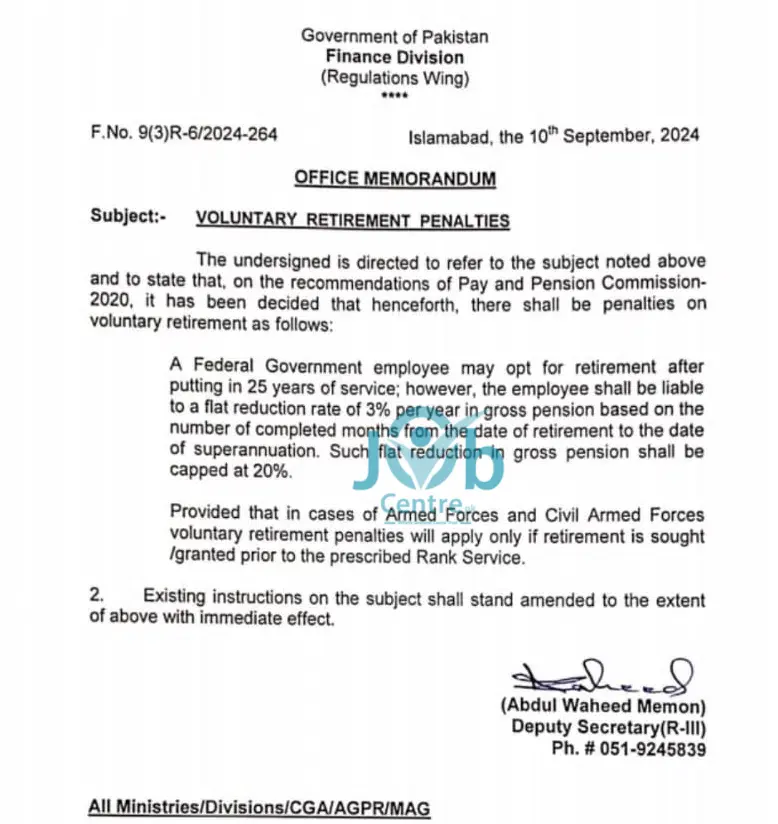

The Finance Division has introduced new penalties for voluntary retirement based on recommendations from the Pay and Pension Commission 2020.

Penalties for Voluntary Retirement:

- Eligibility for Retirement:

- Federal Government employees can retire after 25 years of service.

- Reduction in Pension:

- Employees opting for voluntary retirement will face a reduction of 3% per year in their gross pension.

- This reduction is calculated based on the number of months from retirement to the superannuation date.

- The maximum reduction cap is 20%.

- Special Cases for Armed Forces:

- The penalties apply only if retirement is sought before reaching the prescribed rank service.

Implementation:

- These changes are effective immediately and will update existing instructions.

Contact:

Abdul Waheed Memon

Deputy Secretary (R-III)

Phone: 051-9245839

Read Also: Allama Iqbal Open University AIOU Jobs 2024