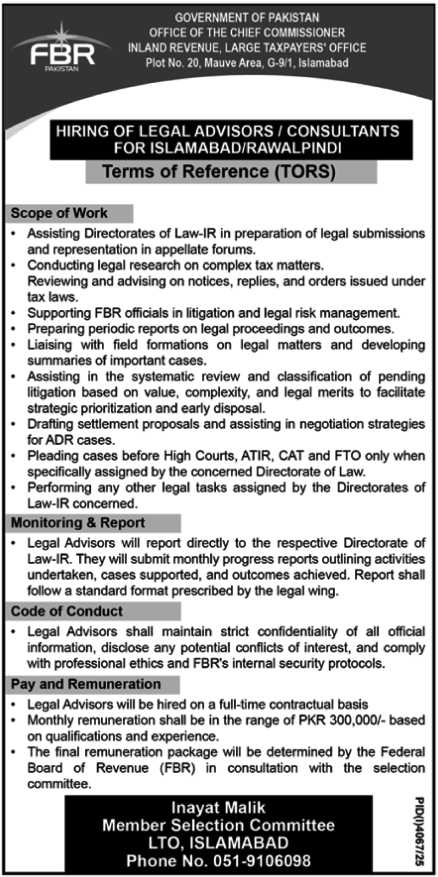

The Federal Board of Revenue (FBR) has officially announced new vacancies for Legal Advisors / Legal Consultants for Islamabad and Rawalpindi. These jobs are being offered under a full-time contractual arrangement with an attractive monthly package of PKR 300,000+, depending on qualifications and experience.

This article explains everything you need to know about the FBR Legal Advisor Jobs 2025, including the scope of work, eligibility, required skills, responsibilities, monitoring and reporting system, code of conduct, salary package, and how to apply. All information is written in simple English and fully optimized for Google search.

How to Apply for FBR Hiring of Legal Advisors Consultants 2025 – Complete Details, Eligibility, Salary & TORs Explained?

1. Prepare your updated CV, law degree, bar membership, and experience certificates.

2. Submit your application to the Member Selection Committee, LTO Islamabad, at the given contact/address.

3. Wait for the interview call and final selection by the Federal Board of Revenue (FBR).

PITB Jobs 2025

What Are FBR Legal Advisor Jobs 2025? – Complete Overview

The Inland Revenue, Large Taxpayers’ Office Islamabad has invited applications from professional legal experts for high-level advisory, litigation, and consultancy work. These positions are created to support FBR’s legal directorates in:

Tax litigation

Legal submissions

Representation in courts

Legal research on tax matters

Providing legal risk management input

Legal Advisors will directly support the Directorates of Law-IR in improving tax cases, reducing pending litigation, and ensuring strong representation in legal forums.

Federal Board of Revenue - FBR Jobs Latest

| Posted on: | November 15, 2025 |

| Category: | Legal Jobs |

| Organization: | FBR |

| Newspaper: | Nawaiwaqt Jobs |

| City: | Islamabad |

| Province: | Pakistan |

| Education: | LLB |

| Last Date: | November 30, 2025 |

| Vacancies: | Multiple |

| Company: | Federal Board of Revenue - FBR |

| Address: | Member Selection Committee Large Taxpayers’ Office (LTO) Plot No. 20, Mauve Area, G-9/1 Islamabad, Pakistan Phone: 051-9106098 |

PSW Jobs 2025

Key Responsibilities of FBR Legal Advisors – Scope of Work (Complete TORs)

Below is the detailed Scope of Work as mentioned by FBR in the official Terms of Reference (TORs). These responsibilities are extremely important for applicants to understand.

1. Preparation of Legal Submissions & Court Representation

Legal Advisors will assist Law-IR Directorates in:

Preparing legal submissions

Preparing pleadings

Representing FBR in various courts and appeal forums

This includes High Courts, ATIR, CAT, FTO (as assigned).

Keyword Focus: FBR legal advisor job responsibilities, FBR court representation, FBR legal submissions.

MOD Jobs 2025

2. Conducting Legal Research on Complex Tax Matters

Advisors must conduct detailed legal research related to:

Income tax

Sales tax

Federal excise

Appeals and orders under tax laws

This research will help FBR strengthen its stance in major cases.

3. Reviewing Notices, Replies & Orders under Tax Laws

FBR handles thousands of notices, replies, and orders every year. Legal Advisors are responsible for:

Reviewing legal notices

Examining tax replies

Studying orders under income tax, sales tax & excise laws

Identifying weak areas

Suggesting improvements to FBR legal strategy

4. Supporting FBR in Litigation & Legal Risk Management

This includes:

Assessing risks

Advising on legal exposure

Providing strategy to avoid potential legal issues

This is one of the most sensitive responsibilities as it directly impacts FBR’s legal success rate.

5. Preparing Periodic Reports on Legal Proceedings

Legal Advisors must prepare:

Progress reports

Case-wise updates

Status summaries

Outcome reports

These reports must follow FBR’s standard format.

6. Liaison with Field Formations on Legal Matters

Legal Advisors will maintain strong coordination with:

Regional Tax Offices

Commissioners

Legal Wings

Directorate of Law

They will also help in drafting summaries of important tax cases.

7. Classification & Review of Pending Litigation

A major responsibility is to assist in classifying pending cases based on:

Value

Complexity

Legal merit

Urgency

This helps FBR prioritize cases and ensure faster disposal.

8. Drafting Settlement Proposals & Supporting Negotiations

Legal Advisors will support FBR in:

Drafting settlement proposals

Helping in ADR (Alternative Dispute Resolution) strategies

Assisting in negotiations

This role requires experience in mediation and tax settlement laws.

9. Legal Assistance in High Courts, ATIR, CAT & FTO

Legal Advisors may be assigned to plead cases only when:

A specific direction is issued by the concerned Directorate of Law

This ensures legal representation remains controlled and well-coordinated.

10. Performing Any Other Legal Tasks Assigned by Directorate of Law

Additional responsibilities may include:

Drafting legal opinions

Reviewing contracts

Supporting special tax investigations

Advising on new tax policies

Monitoring & Reporting Structure for FBR Legal Advisors

FBR has defined a strong reporting structure to ensure accountability:

Legal Advisors will report directly to the relevant Directorate of Law-IR

Monthly progress reports must be submitted

Reports must include details of:

cases undertaken

support provided

outcomes achieved

A standard reporting format will be used

This structured system ensures transparency and performance measurement.

Code of Conduct for FBR Legal Advisors – Professional Ethics Required

Legal Advisors must strictly follow:

Confidentiality of all official information

No conflict of interest

Ethical behavior

Compliance with FBR’s internal security protocols

Professional attitude in dealing with government officers

Any violation may lead to termination.

FBR Legal Advisor Salary & Contract Details

According to FBR:

Monthly Salary: PKR 300,000 or more, based on experience

Type of Job: Full-time consultancy contract

Final package: Determined by the FBR Selection Committee

This makes it one of the highest-paying public sector legal roles in Pakistan.

Eligibility Criteria for FBR Legal Advisor Jobs 2025

To apply for these prestigious legal positions, candidates must meet the following criteria:

1. Law Degree from a Recognized University

Minimum requirements usually include:

LLB

LLM (preferred)

Bar-at-Law (additional advantage)

2. Experience in Tax Litigation

The ideal candidate must have experience in:

Income tax litigation

Sales tax legal matters

Federal excise legal cases

Complex tax arguments

Dealing with judicial forums

3. Strong Research & Drafting Skills

A candidate must be able to:

Draft legal submissions

Prepare notices and replies

Conduct legal research

Summarize complex tax cases

4. Understanding of FBR Laws & Procedures

Knowledge of:

Income Tax Ordinance 2001

Sales Tax Act 1990

Federal Excise Act 2005

ADR laws

Tribunal rules

is required.

How to Apply for FBR Legal Advisor Jobs (Simple 3-Line Method)

Step 1: Prepare your updated CV, law degree copies, experience certificates, and bar membership.

Step 2: Submit your application to the FBR Selection Committee (LTO Islamabad).

Step 3: Wait for interview call and final selection by FBR’s committee.

FBR Legal Advisor Jobs Address & Contact Details

Member Selection Committee

Large Taxpayers’ Office (LTO)

Islamabad

Phone: 051-9106098

Why These Jobs Are a Great Opportunity for Lawyers?

FBR is one of Pakistan’s most important institutions. Working as a Legal Advisor offers:

✔ Strong salary package

✔ High-level case exposure

✔ Direct involvement in national tax litigation

✔ Chance to represent FBR in major courts

✔ Long-term career growth in tax law

This job is ideal for lawyers who want to specialize in taxation and government litigation.

Frequently Asked Questions (FAQs)

1. What is the salary of FBR Legal Advisors?

The salary starts from PKR 300,000 per month and increases based on qualifications and experience.

2. Is this a permanent government job?

No, it is a full-time contractual consultancy position.

3. Can fresh graduates apply?

No. Only experienced lawyers with a tax litigation background should apply.

4. What courts will Legal Advisors appear in?

High Courts, ATIR, CAT, FTO—but only when assigned by Directorate of Law.

5. Where is the job location?

Islamabad and Rawalpindi.

6. Who evaluates performance?

The respective Directorate of Law-IR, based on monthly progress reports.